Our Services

Your Source For Portfolio Analysis, Reporting And Data

Asset Owners

Gain insights to proactively manage your institutional asset pools and provide fiduciary oversight.

Investment Consultants

Streamline portfolio analysis with straight-through reporting to augment fiduciary responsibilities.

Asset Managers

Gain exposures to new opportunities and differentiate your investment strategies to grow assets.

Wealth Managers

Win and retain more business with the in-depth portfolio analysis that ultra-high net worth clients expect.

Worldwide

Trusted By Institutional Investors And Advisors Worldwide

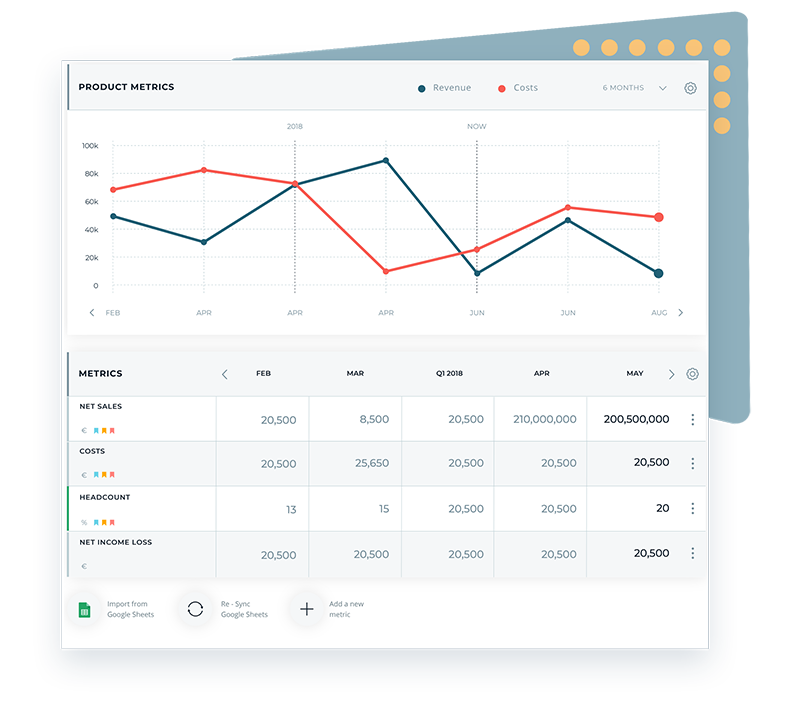

Manage your investment with ease

Oxyfinz supports 17 different transactions and automatically calculates fund performance metrics, within one fund or across different funds.

Oxyfinz dashboards are constantly updated and provide you with a comprehensive snapshot of your fund investments in real-time.

Customize Metrics and KPIs template for each Portfolio Company

Choose from the extensive list of metrics or create your own! Be it financials, balance sheet items, marketing metrics or ESG metrics, Oxyfinz has you covered.

Plus, you’re able to predict growth patterns of your portfolio companies with the forecasted and actual value of any KPIs that matter to you.

Evaluate your investment in multiple currencies

See how much your investments are affected by FX fluctuations with just a few clicks.

DATA SECURITY IS OF UTMOST IMPORTANCE

OXYFINZ meets international information security standards and is IS0-27001 certified.

DATABASE ENCRYPTION

All our databases are encrypted with 256-bit keys (AES-256). Industry consensus is that it would take a supercomputer millions of years to crack the encryption via a brute force attack.

COMMUNICATION

All data sent to the web browser is encrypted (with technology such as HTTPS). This means that third parties need to break the encryption to see what is being sent to your browser.

ETHICAL HACKERS

We regularly engage professional ethical hackers to try, and break into our infrastructure and assess all security aspects.

ACTIVE MONITORING

We use active monitoring tools that ensure all our software code matches the highest security standards.

FIREWALLS

Our infrastructure is secured behind advanced firewall systems. We also have high-end anti-virus and anti-malware scanning our systems.

2 FACTOR AUTHENTICATION

We practice two factor authentification. 2FA provides an additional layer of security beyond strong passwords.